Sports betting involves risk. That is part of the appeal. But not every bettor wants full exposure. Some prefer balance. Hedging offers that balance. It reduces potential loss. Sometimes it locks in profit. Understanding how it works changes how you manage risk.

What Hedging Really Means

Hedging is placing a second bet. It covers the opposite outcome. The goal is simple. Reduce uncertainty. Instead of relying on a single result, you create two possible outcomes. You may not win big. But you avoid losing everything. Hedging shifts the focus from maximum profit to a controlled outcome.

When Hedging Makes Sense

Odds move during games. A team you backed at high odds may now be favored. This creates opportunity. You can bet the other side at new odds on sport bets. If done correctly, both outcomes produce profit.

Before a Big Event Ends

As the game progresses, uncertainty decreases. If your original bet looks strong, hedging can protect gains. This is common in live betting. Timing matters.

Simple Example of a Hedge

You back Team A with $100 at 3.00. If they pull it off, you’re looking at $300 back.

Midway through the game, Team A goes ahead. Now the odds on Team B drift out to 4.00.

Place $75 on Team B to balance things out.

Now:

- If Team A wins, you earn a profit from the first bet.

- If Team B wins, the second bet covers most of the loss.

The exact amounts depend on the calculation. The principle stays the same.

Different Ways to Hedge

Opposite outcome hedge is the most common method. Bet the other side. Simple. Direct. Works best when odds change significantly.

Partial Hedge

You do not need to cover the full amount. A partial hedge reduces risk but keeps some upside. This balances safety and profit.

Cross-Platform Hedge

Some bettors use different bookmakers. They take advantage of price differences. This requires research and speed.

How to Calculate a Hedge Properly

Calculation matters. Guessing creates mistakes. Use this basic formula:

- (Hedge Amount) = (Original Bet × Original Odds) ÷ New Odds

This gives a balanced result. Always double-check numbers. Small errors change outcomes.

Advantages of Hedging

Hedging offers clear benefits:

- Reduces emotional stress

- Protects potential profit

- Limits large losses

- Adds flexibility during live betting

Many bettors use hedging as a risk tool. It creates control in uncertain moments.

The Downsides of Hedging

Hedging often lowers potential winnings. You sacrifice upside for safety. This trade-off must be accepted.

Extra Fees or Margins

Bookmakers build margin into odds. Multiple bets mean multiple margins. This reduces efficiency. Hedging too often can erode value.

Over-Hedging Creates Confusion

Constant adjustments complicate the strategy. Too many moving parts increase mistakes.

Emotional Hedging vs Strategic Hedging

Emotional hedging happens when a bettor panics. They place a hedge without calculation. This often reduces profit unnecessarily.

Strategic hedging is planned. The bettor understands numbers. They act with purpose. Strategy protects value. Emotion weakens it.

Live Betting and Hedging

Live betting makes hedging easier. Odds update in real time. Cash-out options appear. Some platforms offer automatic cash-out. This acts like a built-in hedge. But always compare the manual hedge vs the cash-out value. Cash-out often includes a hidden margin.

Bankroll Management and Hedging

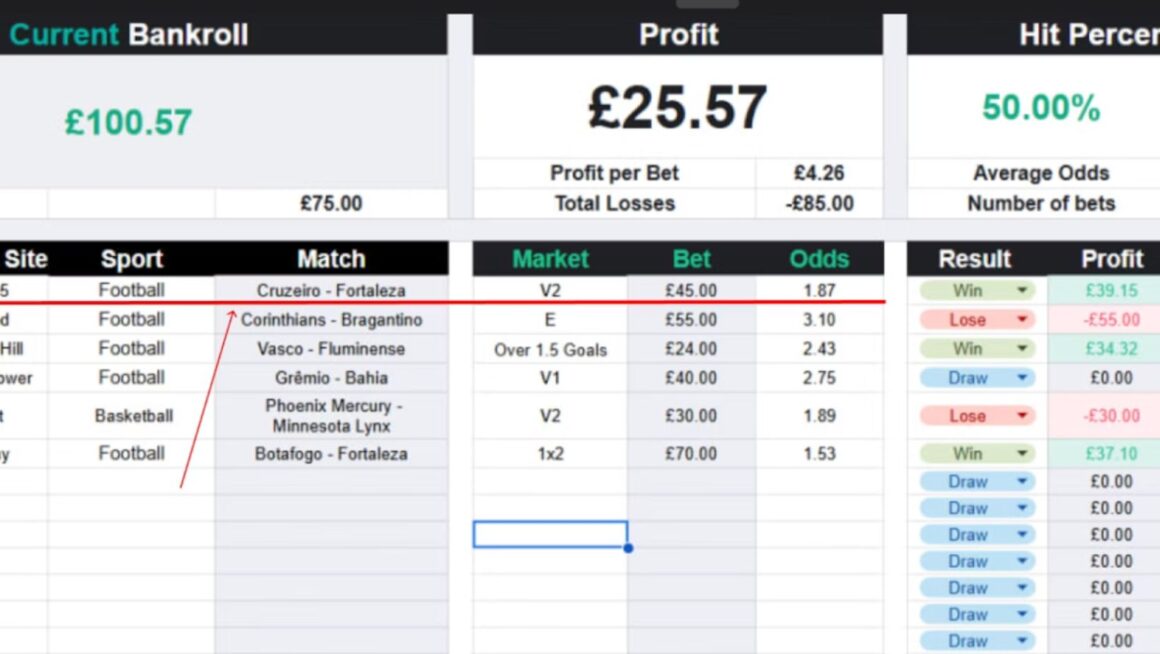

Hedging works best within a clear bankroll plan. Never hedge with money you cannot afford. Track every bet. Record profit and loss. Discipline strengthens strategy. Without discipline, hedging becomes random.

When Not to Hedge

Not every situation requires it. Avoid hedging when:

- The value still favors your original bet

- The hedge reduces profit too heavily

- The emotional urge outweighs calculation

Sometimes the best move is patience.

Tools That Help With Hedging

Several tools make hedging easier:

- Betting calculators

- Odds comparison sites

- Live score tracking apps

- Spreadsheet tracking

These tools reduce error. But they do not remove risk.

Common Mistakes to Avoid

New bettors often make errors. They hedge too early. They miscalculate stake sizes. They forget to factor in commission. They chase losses with unnecessary hedges. Avoid rushing. Hedging should feel deliberate.

Understanding Arbitrage vs Hedging

Hedging reduces risk after a bet is placed. Arbitrage exploits price differences simultaneously. Arbitrage aims for guaranteed profit. Hedging aims for risk control. The goal is different.

Arbitrage Requires Precision

Arbitrage depends on small price gaps. It requires speed and multiple accounts. Hedging is more flexible. Most casual bettors use hedging, not arbitrage.

How Hedging Affects Long-Term Discipline

Hedging can protect confidence. Big losses hurt less. That stability helps maintain discipline. But constant hedging can reduce growth. If every bet is softened, long-term returns may shrink. Balance matters. Use hedging as a tool. Not a habit.

Is Hedging Always Profitable?

No. Hedging reduces variance. It does not guarantee profit. Market margins remain. Bookmakers still hold an advantage. Hedging is a risk tool. Not a magic formula.

Hedging in Futures and Long-Term Bets

Futures bets last weeks or months. Championship winners. Season totals. Award markets. These bets create long windows. If your selection reaches the final stage, the value increases.

You can hedge late in the tournament. This protects profit without waiting for the final result. Timing becomes more important than prediction.